What awaits individual entrepreneurs and microbusiness in Belarus

https://sputnik.by/20211204/chto-zhdet-ip-i-mikrobiznes-v-belarusi-1058473484.html

What awaits individual entrepreneurs and microbusiness in Belarus

What awaits individual entrepreneurs and microbusiness in Belarus

Next year will be a pilot one for testing the system of small business operation. 12/04/2021, Sputnik Belarus

2021-12-04T21: 53 + 0300

2021-12-04T21: 53 + 0300

2021-12-04T23: 20 + 0300

economy

Belarus news

Dmitry cool

sp

small business

/ html / head / meta[@name=”og:title”]/@content

/ html / head / meta[@name=”og:description”]/@content

https://cdnn11.img.sputnik.by/img/101939/38/1019393890_0-0:4128:2322_1920x0_80_0_0_29785feb71ffc3a9449babdc5f19c475.jpg

MINSK, 4 Dec – Sputnik. What changes await microbusiness and individual entrepreneurs in Belarus in the next 2022, the deputy head of the Presidential Administration Dmitry Krutoy said on the air of the Belarus 1 TV channel. There are, of course, ideas for transforming this sector. Like a snow on your head: what entrepreneurs say from the draft Tax Code & gt; & gt; “If we are talking about microbusiness, this is almost 800 thousand people – 20% of those employed in our economy,” the official allowed. The head of the Presidential Administration drew attention to several problems associated with the new rules for the work of individual entrepreneurs and microenterprises. First, the simplicity and efficiency of regulation. “Next year,” said Krutoy. Has the IP registration been stopped in Belarus? What entrepreneurs are saying & gt; & gt; He clarified that today there are a number of categories: 96 thousand micro-enterprises, 270 thousand individual entrepreneurs, 40 thousand artisans, about 45 thousand self-employed. In addition, the activities of agricultural estates are also regulated separately. In addition, according to Krutoy, representatives of microbusiness participate in financing government spending. on the usual tax system he pays 11 thousand rubles. The entrepreneur who uses the simplified tax system pays only 1.9 thousand rubles in tax. He. According to the data cited by Dmitry Krutoy, when entrepreneurs switched from “simplified” to a single tax, the amount of tax revenues decreased by 40%, in 2020 by 30%. not taxes are impossible, “- the deputy head of the presidential administration.” electronic tax platform. In addition, the country has long overdue the adoption of a law on microbusiness. “The deputies, our parliamentarians must work. The topic is sensitive. And the law will be the most correct decision “, – Dmitry Krutoy was accused. different incomes, because differentiation is needed here, “said Dmitry Krutoy. He added that for individual entrepreneurs, for certain types of trade, the types of taxation system will still remain for the next year. “For some types it will be canceled. The rates of the single tax will be increased, but it is planned that from 2023 entrepreneurs will go to a single form of taxation – the payment of income tax at an increased rate of 18%,” the source said in an interview with Belarus 1. in his opinion, such a gradation is quite simple and understandable, and such measures will also increase the efficiency of this segment of the economy.

https://sputnik.by/20211204/minsk-khochet-uravnyat-nalogovye-stavki-dlya-vsekh-internet-magazinov-v-eaes-1058474145.html

Belarus news

2021

news

Ruby

economy, news of belarus, dmitry krutoy, ip, small business

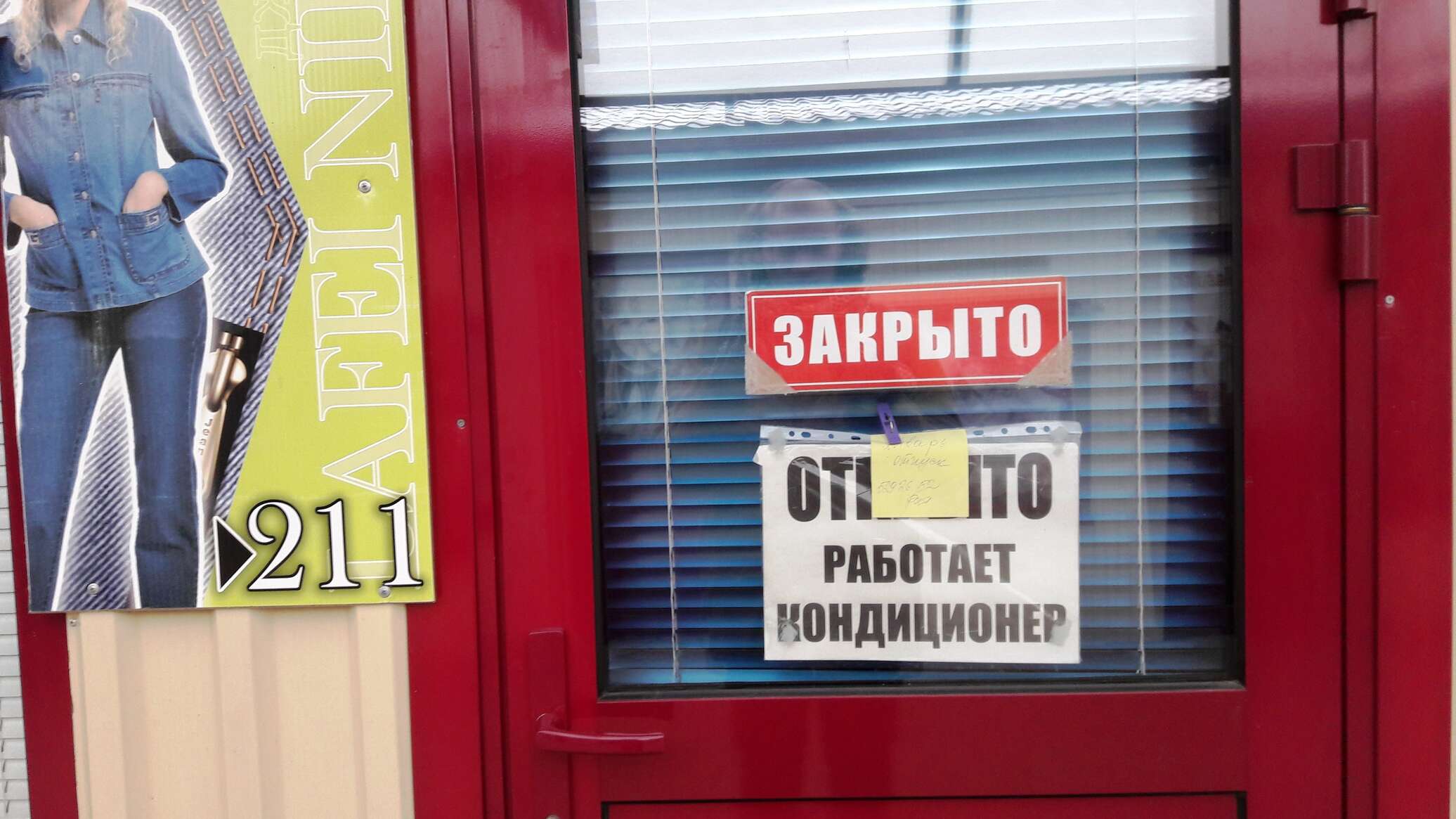

Next year will be a pilot one for testing the system of small business operation.

MINSK, 4 Dec – Sputnik. What changes await microbusiness and individual entrepreneurs in Belarus in the next 2022, Deputy Head of the Presidential Administration Dmitry Krutoy told on the air of the Belarus 1 TV channel.

The Institute of Individual Entrepreneurship in Belarus is now being transformed: the final version of the draft Tax Code should arrive in Belarus in 2022, already prepared for approval.

“Certain thoughts, ideas for transforming this sector, of course, are.

He noted that small business, microbusiness occupies a very important share in the Belarusian economy.

“If we are talking about microbusiness, it is almost 800 thousand people – 20% of those employed in the economy,” we are an Adviser.

The Deputy Head of the Presidential Administration drew attention to several special ones related to the new rules for the work of individual entrepreneurs and micro-enterprises. First, the simplicity and efficiency of regulation.

“The categories of microbusiness that we have today should be reformatted next year,” said Krutoy.

He specified that today there are a number of categories: 96 thousand micro-enterprises, 270 thousand individual entrepreneurs, 40 thousand artisans, about 45 thousand self-employed. In addition, the activities of agricultural estates are also regulated separately.

“Of course, for our country there is already a certain amount of confusion in this. We need changes, a simpler system,” Dmitry Krutoy is sure.

Secondly, according to Krutoy, representatives of microbusiness participate in financing government spending.

One employed in microbusiness pays 7.5 thousand rubles in taxes. One individual entrepreneur on a conventional system pays 11 thousand rubles. Unfortunately, they are a minority. The entrepreneur who uses the simplified tax system pays only 1.9 thousand rubles in tax. And an entrepreneur pays 1.7 thousand rubles on a single tax, “he said.

According to the data cited by Dmitry Krutoy, when entrepreneurs switched from “simplified” to a single tax, the amount of tax revenues decreased by 40%, in 2020 by 30%.

“Such figures cannot be ignored. It is impossible to be in the gray zone and not pay taxes, ”the deputy head of the presidential administration is allowed.

The third point is the introduction of cashless payments.

“No one in the world has figured out how to defeat this evil – wages in envelopes, tax evasion,” said Krutoy.

In his opinion, the introduction of a full-fledged electronic tax platform in the country by January 1, 2023 should help.

In addition, the country is long overdue for the adoption of a law on microbusiness.

“The deputies, our parliamentarians must work. The topic is sensitive.

And fourth. In terms of taxation, the country is increasing the size of the single tax, the official said.

“This topic is left to the mercy of local authorities, in the regions, taking into account income and demand, the situation is different, people have different incomes, because differentiation is needed here,” said Dmitry Krutoy.

He added that for individual entrepreneurs, for some types of trade, the simplified taxation system will still remain for next year.

“For some types it will be canceled. The rates of the single tax will be increased, but it is assumed that from 2023 entrepreneurs will go to a single form of taxation – payment of income tax in an amp of 18%,” the source said in an interview with Belarus 1.

So, for the self-employed there will be new changes, from 2023, by analogy with the EAEU countries, a tax on professional income will be introduced. Its essence is clarified by Dmitry Krutoy:

“10% of the proceeds will need to be paid if you work with individuals, 10% – if you work with legal entities up to a certain threshold. And after 20% tax ”, – the representative of the Presidential Administration explained the nuances of the innovations.

In his opinion, such a gradation is quite simple and understood, and such measures will also increase the efficiency of this segment of the economy.