Energy is at the heart of Bulgaria’s Recovery Plan

The plan does not support economic analysis for an overall assessment of the impact of projects at the sectoral level

07:27 | November 8, 2021

author:

Bloomberg TV Bulgaria

Bulgaria’s recovery plan has already been presented to Brussels, and the European Commission will now be reviewed and evaluated. It contains a description of national structural reforms and investments that will be supported by European funding under the Recovery and Sustainability Mechanism. The project must meet 11 Commission criteria in order to be approved.

The Bulgarian plan is structured in 4 pillars and the goal is to recover and transform the economy after the covid crisis, and the change should have a lasting positive impact on the business environment and professionals, climate change and digital development. Ultimately, in the long run, the NAP is expected to contribute to Bulgaria’s convergence with the European economy and income, according to the Institute for Market Economics.

An essential part of the documentation of each country’s recovery plan is a list of projects that will be funded through it. These are the specific investment intentions, detailed in a standard format. In the latest version of the plan, according to the Deputy Chairman of the Department of European Funds Atanas Pekanov, half of the projects have been revised and currently it contains 60 projects, divided by sectors, as shown in the chart.

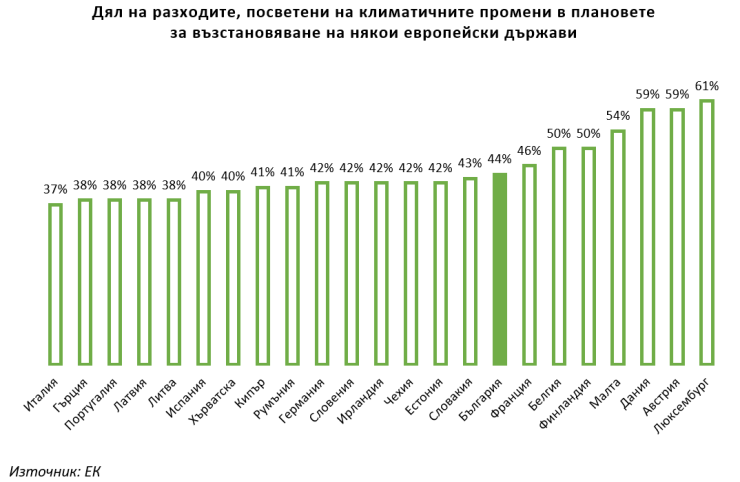

Just over 44% of the total funds will be spent on projects in the fields of energy and energy efficiency. This is understandable, as one of the main criteria of the European Commission is at least 37% of the costs set aside for reforms and projects to combat climate change. In practice, this means addressing climate change through investments in energy, transport, agriculture, the environment and more. Another relatively priority sector for investment in the Bulgarian plan is all education, as 9.2% of project funding is directed there.

If we have to make a comparison with the European countries, whose plans have already been approved (with the agreement that in the sector of measures to combat climate change, other than energy can be included), it is impressive that Bulgaria has been chosen to finance energy projects above the minimum needs of the Commission and to a greater extent than European countries with similar economic development. The leading countries in this regard (Luxembourg, Austria and Denmark) have a serious priority for the green transition – about 60% of the total costs in their plans.

The energy projects in the Bulgarian plan are 10, and this is the largest funding is “Scheme in support of the construction of at least 1.7 GW of RES and batteries in Bulgaria.” The project aims to integrate into the electricity grid a large percentage of renewable energy sources, combined with the construction of the minimum required capacity for storage of electricity (batteries). It is interesting that the project has a total value of BGN 2.7 billion, of which BGN 1.8 billion are privately funded, and just under BGN 1 billion are from the Mechanism for Recovery and Sustainability.

The second largest project funding in this area is the “Scheme to support decarbonisation processes through the construction of high-efficiency low-carbon power plants instead of coal-replacing capacity in the coal regions”. Its total budget is BGN 1.7 billion, and here a significant share is financed to come from the private sector (including investments in nature worth BGN 0.7 billion). The project is expected to receive both through the Mechanism for Reconstruction and Sustainability and through the Modernization Fund. This may be the project that has received the greatest public response, as a central gas trader has generally been built to replace coal-fired power.

However, the third energy project, which is the largest with the largest EU funding, is “Support for sustainable energy renovation of the housing stock” (or the so-called renovation of residential buildings). It is worth a total of BGN 1.4 billion, of which BGN 1.2 billion is European funding and the improvement of the energy performance of the national built-in housing stock, the saving of first energy for the renovated residential buildings and the achievement of a class of energy consumption minimum “B” after the application of energy saving measures in residential buildings. Experience to date shows that quite common people prefer housing rehabilitation projects, as they have a clear and visible result and provide an opportunity to carry out activities outside the standard scope of municipal budgets.

Unfortunately, the recovery plan does not contain an economic analysis of the overall impact assessment of projects at sectoral level, which means that it is very difficult to assess what the results of their impact will be and how far the energy policy objective will be achieved. The ones described in the energy policy reform plan are very far from the definition of structural reforms, as it seems that there are no clear goals and results, time horizon, indicators for measuring the set and it is not possible to assess their connection with the project. This is a shortcoming from which it has suffered the announced reforms in other sectors, but it is especially visible in the energy sector. Whether what is presented in the plan is necessary for the European Commission remains to be seen, but from the visible point of national policy and interests there is still much to be desired.