Housing prices in the world. Why is Prague average and Turkey is enormously expensive?

Prague real estate prices continue to rise to unbearable heights. Nevertheless, they could be described as low compared to other world capitals. And their growth last year was rather average.

In the capital, the acquisition amount for one square meter is now around a barely believable 120,000 crowns. The buyer will get below the six-digit limit only in the outskirts of Prague.

On the contrary, if they are looking for more spacious, modern living in more desirable locations, they will pay a lot more. The average price at “better“ real estate is 180 thousand crowns per square meter.

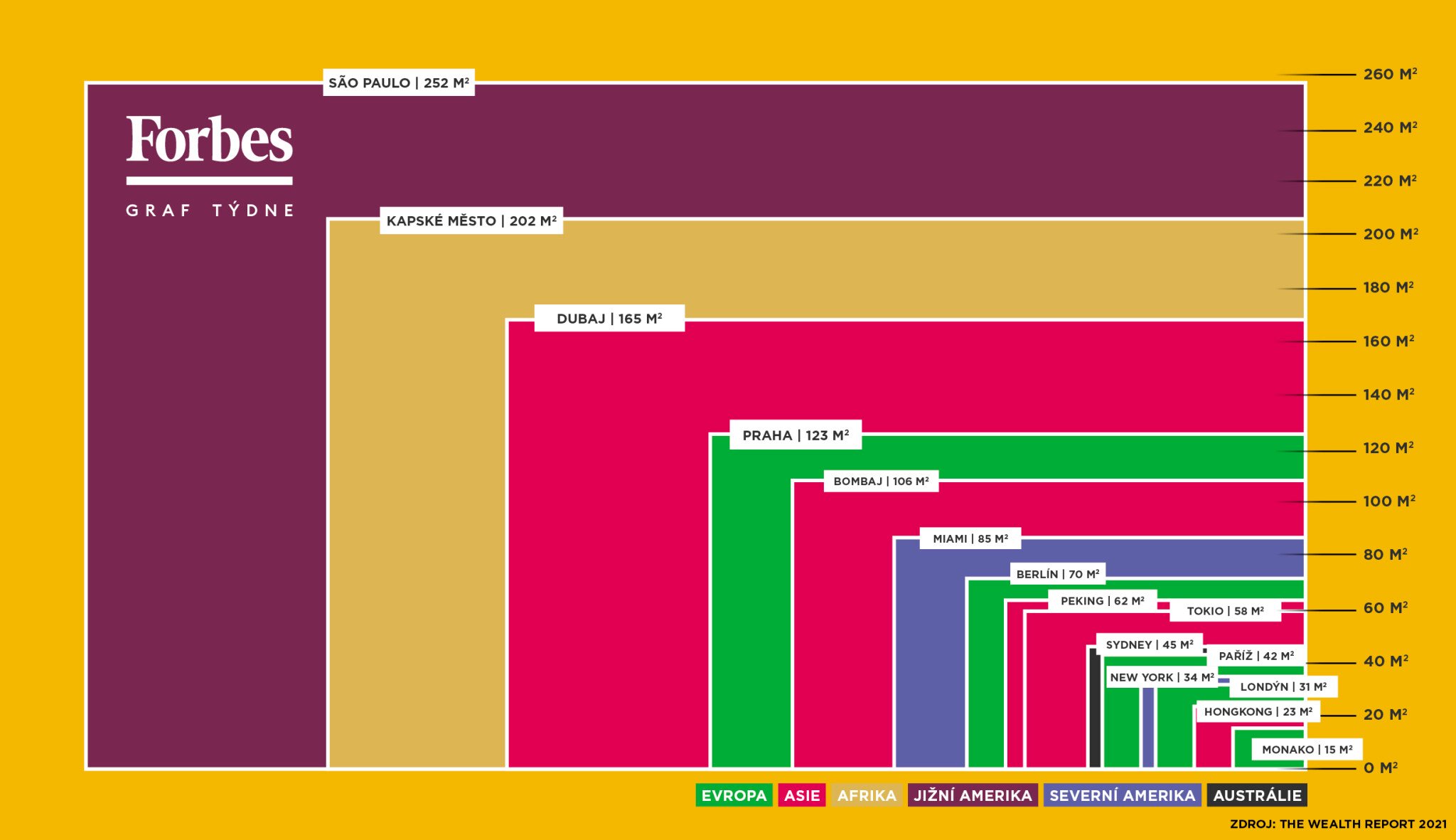

After all, London analysts compiling Regularly also operated with this number The Wealth Report, which, among other things, compares dozens of key real estate markets around the world each year and provides an insight into how many square meters of above-standard housing people can buy in individual cities for a million dollars (roughly 22 million crowns).

They were based on real sales prices and the current exchange rate at the end of 2020.

According to this criterion, they concluded that for a million dollars you would buy the smallest living space in the city-states of Monaco (15 square meters) and Hong Kong (23 square meters), which have held the first two positions in recent decades. Send London, New York and Geneva, Switzerland, jumped to fifth place, where prices rose by more than seven percent last year.

Praguers can then buy an apartment with an average area of 123 square meters for the same amount. The Czech capital, which was not included in the original study, was additionally calculated by analysts according to the same methodology for Forbes.cz.

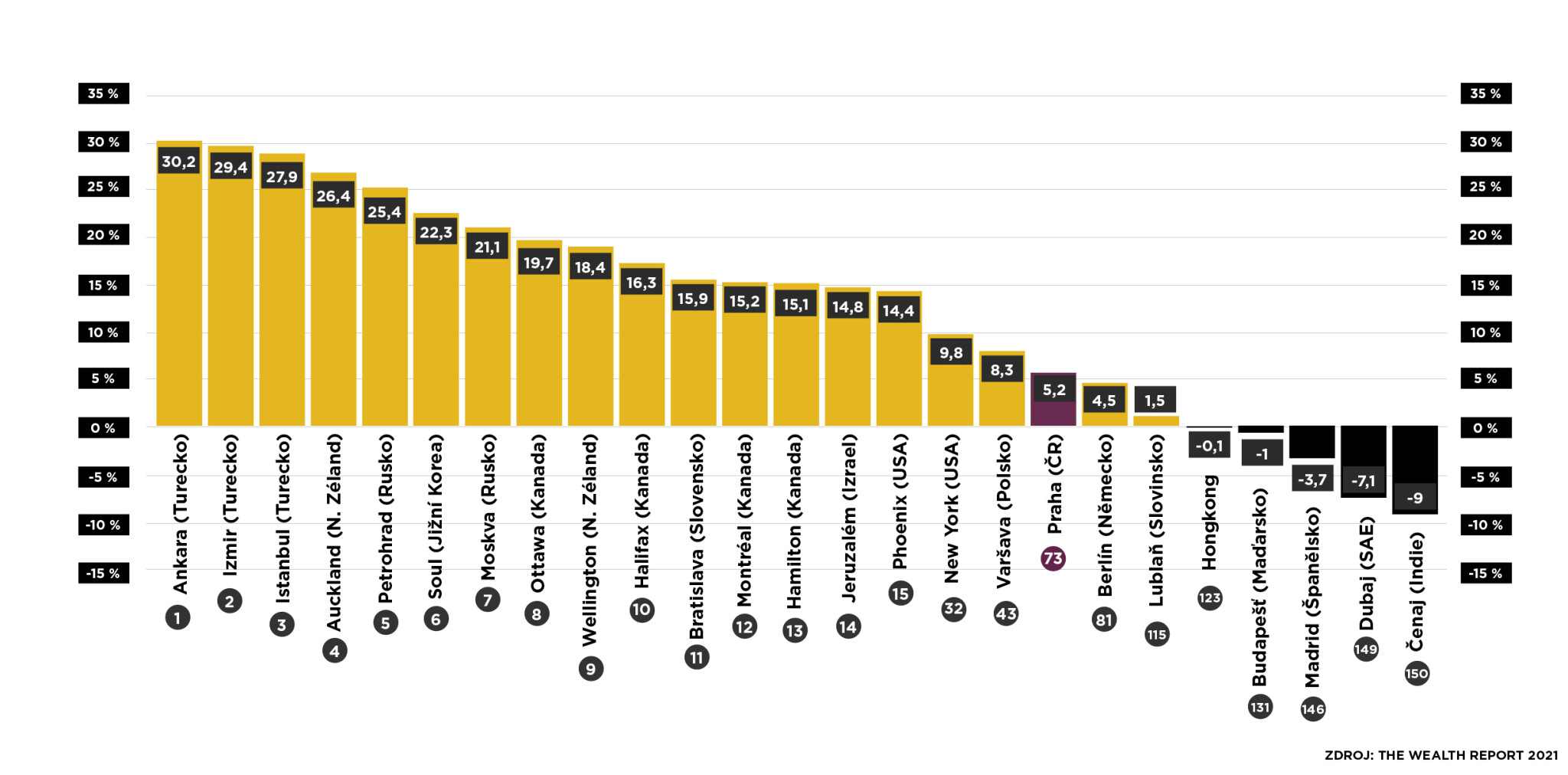

The global real estate company Knight Frank, which publishes The Wealth Report, also compared how real estate prices fluctuated around the world last year.

As a result, they grew the most (by almost a third) in Turkey, whose cities Ankara, Izmir and Istanbul occupied the top three, followed by Russia (St. Petersburg, Moscow) and New Zealand (Auckland, Wellington).

Why Turkey? High inflation and the fall of the Turkish lira in recent months are to blame.

Bratislava, Slovakia, was also at the top of the list (11th) with a year-on-year increase of 15.9 percent. Prague fell into the average and with a price increase of 5.2 percent, it ranked 73rd near Athens, Zagreb, Helsinki and Berlin.

However, it should be mentioned that Prague prices have not been rising in proportion to wages for a long time. While a resident of the Czech capital would earn an average apartment of seventy square meters for fourteen years (if he had no other expenses), a Berliner would need six years less.

Of the 150 cities analyzed, real estate values rose in 81 percent of them. At one-fifth, even at a double-digit rate. There were frequent declines in the Mediterranean and Asia, especially in India. An exception is South Korea’s Seoul, which ranked seventh with a year-on-year growth of 22.3 percent.